Carol Johnson, Southern Indiana Business Report

Construction spending on manufacturing facilities in the United States has doubled since the end of 2021 according to the US Department of Treasury.

The surge has taken place as federal tax incentives and direct funding for manufacturing construction have created opportunities that the public and private sector are taking advantage of.

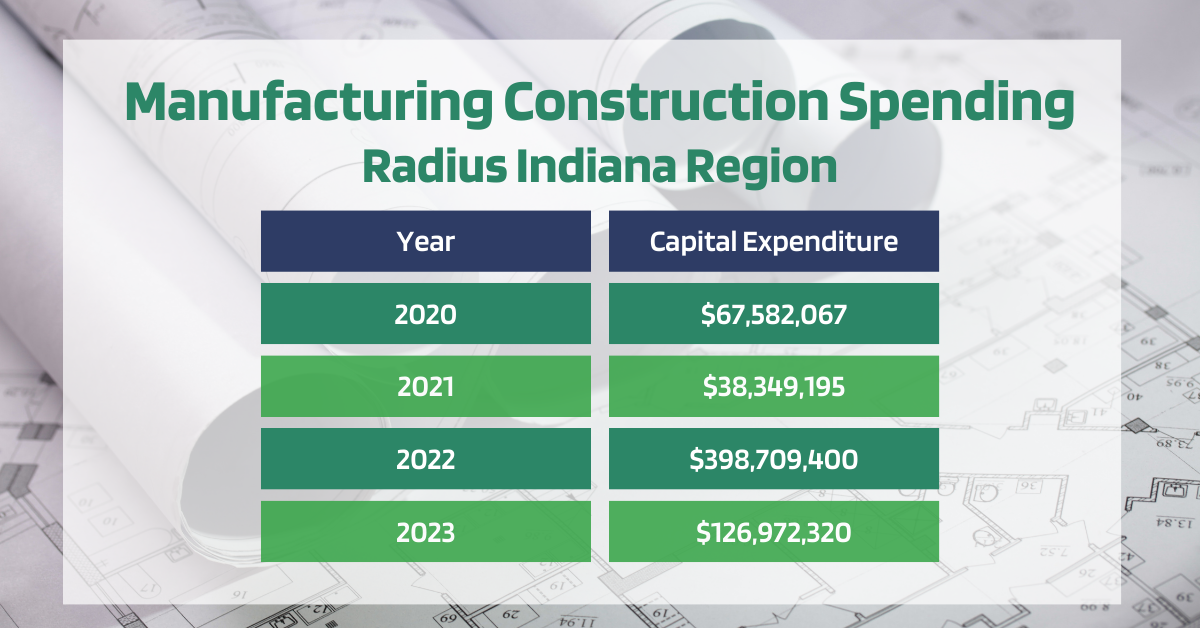

The Radius Indiana region has seen a similar expansion boom.

From 2020-2023, capital expenditures by companies in the Radius region topped $631 million, according to the Indiana Economic Development Corporation. The majority of the investment was made in 2022, which accounted for 63.1% of the four-year total.

In 2022, capital expenditures in the eight-county region totaled $398,709,400, a significant increase over 2021’s $38,349,195.

Microelectronics at WestGate

The new microelectronics campus at WestGate in Daviess County represents the lion’s share of 2022 investment with four companies spending more than $400 million.

The IEDC reports NHanced Semiconductors will spend $355 million, Trusted Semiconductor Solutions $34.3 million, Reliable Microsystems $7 million and Everspin Technologies $65 million.

Illinois-based NHanced Semiconductors will build a 150,000 square-foot fabrication facility it says will be the first built specifically for advanced packaging.

The WestGate One project, which will create 550 jobs, is the largest investment by far, but other projects point to growth in a variety of industries.

In Dubois County, three companies have expanded or constructed new facilities: Indiana Furniture Industries, Sander Processing, a family-owned meat processing business in Dubois County, and Fischer Farms Natural Foods.

Indiana Furniture Industries Inc. in Jasper invested $17.8 million to expand in a new location on the south side of Jasper in 2021 after outgrowing its 100-year-old facility. The project added 15 advanced manufacturing jobs.

In 2020, Sander Processing Inc. invested $2.8 million to build a second location in St. Anthony. The expansion created 24 jobs. In 2021, Fischer Farms invested $958,000.

More recently, Wabash Valley Foods announced plans to expand in Dubois County with a $63 million egg processing facility, the result of Wabash Valley’s partnership with Tyson Foods’ Jimmy Dean brand.

Ed Cole, president of Dubois Strong, the county’s economic development organization, said fears of a recession that didn’t quite take hold, is one reason companies feel confident to expand.

“I think there is a lot more optimism than a year ago, and because of that, there’s a lot more investment,” he said. “For us in Dubois County, seeing this type of business expansion is tremendous because many of these businesses are homegrown that started 50 or 75 years ago. Having those owners continue to invest in our economy and future is fantastic.

“We are very fortunate to have very business-savvy owners,” Cole continued. “They make good investments, they know their markets and they know how to survive in good and bad times.”

In 2021 in Martin County, ManTech Advanced Systems International invested $14.8 million, creating 120 jobs.

Lawrence County projects

In Lawrence County, Shance Sizemore, executive director of the Lawrence County Economic Growth Council, said Heidelberg Materials’ $600 million investment at the Mitchell cement plant (formerly Lehigh) was unprecedented for Lawrence County, but not the only large expansion project.

General Motors in 2020 invested $40.5 million in the Bedford Casting Operations and in 2022 announced an additional $45 million investment to expand capacity for EV castings.

In 2021, Barbaricum, an information technology firm, invested $838,555 in its Bedford operation and McIntyre Bros., a contractor specializing in below-grade and civil work for public utility substation construction, invested about $3 million to upgrade its facility. It allowed them to modernize their equipment and expand their customer base.

Sizemore said the investments create ripples in the local economy.

“At Lehigh, there is increased truck traffic and train traffic so that means additional employees doing the ancillary work. The investment by a company goes beyond the jobs created by that expansion,” Sizemore said. “That money is spent throughout the local economy.”

Expansions outside of a county can also benefit local industry, he said.

“Regionally, we have local companies that do work for Toyota. So when Toyota invests or increases production, our local companies grow to meet that demand,” Sizemore said.

Even with the local expansions across the Radius region, demand is high for space. Sizemore’s office has received more requests for large commercial space in the past six months than he’s fielded his entire career.

“I have nothing over 10,000 square feet,” which he said is not large enough to accommodate most requests.

A future shell building to be built in Mitchell will provide 50,000 square feet of space that can be expanded to twice that size.

CHIPS Act drives growth

An analysis by the US Dept of Treasury found that most of the growth has been driven by computer, electronics, and electrical manufacturing. Since the beginning of 2022, real spending on construction for that specific type of manufacturing has nearly quadrupled.

The type of manufacturing investment can signal what direction a region may be heading to as jobs and growth follow those capital expenditures.

Economics blogger Noah Smith recently noted that from June 2022 to April 2023, construction spending in the US manufacturing industry jumped from $90 billion to $189 billion, indicating the positive building climate created by the passage of the CHIPS Act and the Inflation Reduction Act signed into law in the summer of 2022.

The activity is so strong that manufacturing is the only major category within the US construction market that’s spending at a pace that’s beating inflation, outstripping spending on construction for offices, healthcare, and education purposes.

Nanlee Engineering

A Bedford engineering firm is another company that is expanding its footprint.

Larry Cuba, project manager for Nanlee Engineering, said the engineering firm is spending about $300,000 to add a third building to its facility on Industrial Drive.

“We were out of space,” Cuba said. “We have some projects that we do on our customer sites and they don’t have the floor space anymore, so we had to expand.”

Nanlee is building a 6,000 square-foot building with a loading dock on an acre of land it hadn’t developed yet.

It’s the second building the business has added since 2015.

Cuba said the expansions have allowed Nanlee to add a few employees. They employ seven full-time employees and a part-time accountant. Nanlee, which Cuba said his parents Lee and Nancy started in their garage, makes industrial machine guarding, builds equipment for the underground pipe repair industry and is a welding and repair shop for General Motors.

With interest rates rising and talk in 2022 of a looming economic recession, Cuba said the decision to expand was a bit of a gamble but he believes will pay off.

“We’re taking a chance and getting this built in hopes that the projects will come,” he said. “We’re still a small business but the growth is happening.”