Carol Johnson, Southern Indiana Business Report

Matt Finn hears it everyday. Where are the workers? The United States has the jobs, but not the people to fill them.

The pandemic, which at its height saw 120,000 businesses close their doors temporarily, exacerbated the challenges facing the US workforce, but the reality is, the workforce has been declining for decades.

Finn, an economist for 1834, a division of Old National Bank, said the decline of America’s labor force participation is nothing new, but the factors in play continue to change.

Finn gave an overview of the American workforce and the state of the economy to the Radius Indiana Board of Directors during the Radius board meeting Dec. 13 at the French Lick Resort.

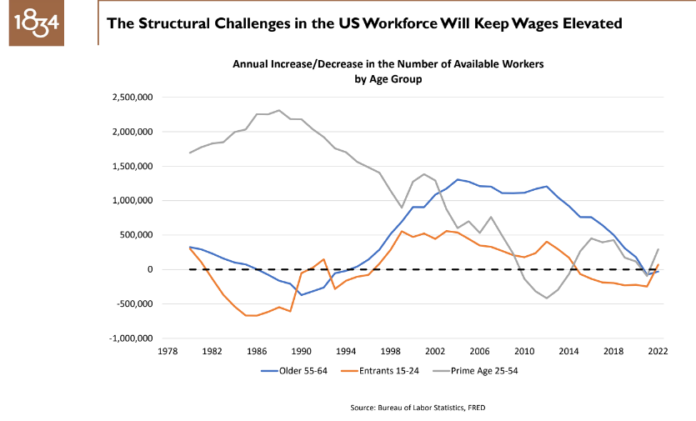

Several factors are creating headwinds for employers trying to fill positions, among them are Baby Boomers retiring, a lowering birth rate and a decline in workforce participation by men.

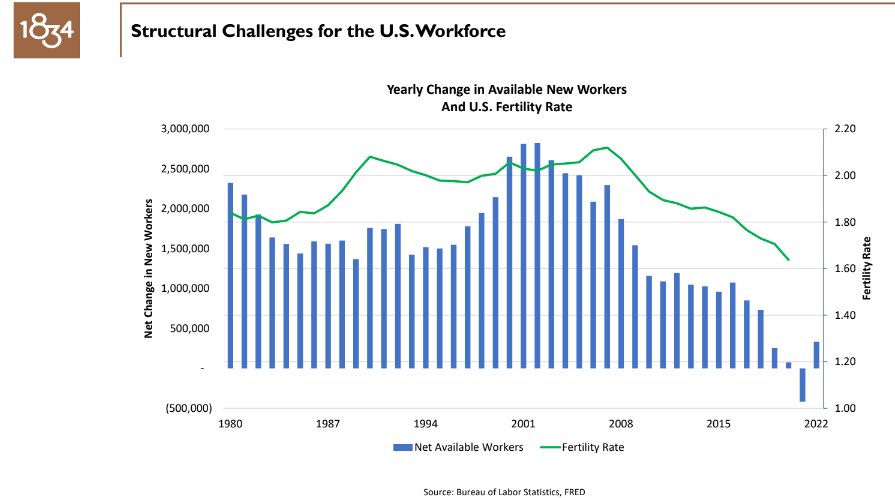

“In 2001, more than 2.5 million new workers were entering the workforce each year,” Finn said. “That has fallen off. Now less than half a million new workers are entering the workforce each year.”

An aging population and declining birth rate are compounding the shortage.

For the next 15 years, more than 10,000 people will turn 65 every day. The current birth rate of 1.65 children per woman is below the 2 children per woman required just to sustain the workforce.

Another change in the workforce is an increase of women. But as women have increased their participation, the percentage of men working has declined.

“In 1948, the labor force participation rate was 85% of men who were able to work and 32% for women,” he said. “In 2000, women were 60% of the workforce.”

The gains by women have been offset by the decline of men, which today hovers around 70% of the workforce.

Women will likely continue to make up a significant portion of the workforce, Finn added, as evidenced by women now making up 60% of college admissions.

More workforce challenges

As younger workers replace retiring workers, that will bring a new set of challenges. Finn said more and more workers are seeking work/life balance, flexibility in workplace, hybrid and remote work models. As more and more manufacturers turn to automation to alleviate the worker shortage, existing employees will need to be reskilled or upskilled.

Finn also addressed the increase of robotics in manufacturing as industries struggle with the labor shortage. However, not all industries have the capital to invest in robotics and those companies will continue to struggle to find workers.

He also noted the tendency in public circles to view robotics as taking jobs away from workers.

“Technology is not a job killer, it’s a job re-allocater,” he said. “Robots can’t care, collaborate or problem solve. They just do a task that no one wants to do.”

Self-checkout, he said, is an example of a basic task that has shifted from paid workers to the consumer, allowing those workers to seek a better job that allows them to reach their full potential.

Economic forecast

Looking ahead, Finn issued the following economic forecast from ONB:

- We think the US economy is set to slow sharply at the start of 2024. We expect GDP growth to come in below trend at 1.2% next year as monetary and fiscal policy restrain activity.

- We continue to think the strength of consumer spending in Q3 is unsustainable against a backdrop of cooling real income growth and excess savings concentrated among more affluent, thriftier households.

- Inflation and the labor market are both consistent with above-target inflation, so we expect interest rates to remain high. We think the first rate cut will occur in September 2024.

- Fiscal policy will be tightened in 2024, in sharp contrast to the significant loosening this year.

- Lags and uneven impacts of tighter monetary and fiscal policy, as well as the behavior of consumers, mean the outlook remains highly uncertain. Although we have removed the recession from our baseline forecast, we think it remains a high probability over the next 12 months.

‘Big themes’ in the next decade

The needs of an aging population and use of AI will further change the landscape. Here are a few shifts Americans can expect to see in the next 10 years and beyond.

- Healthcare – As more than 10,000 Americans turn 65 each day for the next decade, the need for healthcare, particularly care aimed at keeping seniors healthy and out of the hospital and nursing homes, will increase dramatically. Additionally, for the first time, by 2035 there will be more Americans over the age of 65 than under the age of 18. This will result in a seismic shift in consumer spending patterns for both goods and services.

- Artificial Intelligence and Robotics – AI will allow the next “great leap forward” in productivity and economic growth. In a few years, AI will turn millions of business owners into programmers because the next big programming language will be English. The use of robotics and automation will accelerate as the pool of available workers is growing much more slowly than demand. Increased demand for healthcare will drive a need for in-home technology, both AI and robotics, to supplant human caregivers.

- Deglobalization and a manufacturing renaissance – We expect to see both U.S. onshoring of manufacturing and new supply chain alliances forming mainly between Western democracies vs. Eastern totalitarian governments. Not all alliances will be cleanly along ideological lines however, as natural resources are not distributed uniformly across the globe.