By Torrie Sheridan | Purdue University

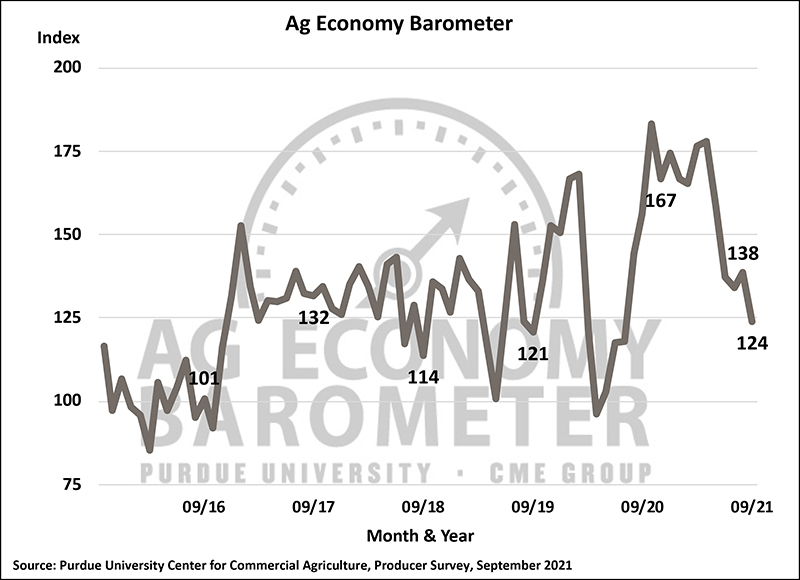

WEST LAFAYETTE — The Purdue University/CME Group Ag Economy Barometer declined in September, down 14 points to a reading of 124. With producers feeling less optimistic about both current conditions on their farming operations as well as their expectations for the future, this is the weakest farmer sentiment reading since July 2020 when the index stood at 118. The Index of Current Conditions declined 12 points to a reading of 140 and the Index of Future Expectations fell 16 points to a reading of 116. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted Sept. 27-29.

The Farm Financial Performance Index was unchanged from last month with a reading of 110. However, examining the detailed responses reveals there was a shift among producers with regard to their farms’ financial performance. In September, fewer farms said they expected their farm’s financial performance to match last year’s, while the percentages of producers expecting both worse and better financial performance rose.

“Although the combined responses left the Farm Financial Performance Index unchanged from a month earlier, the increasing divergence in expectations among respondents from August to September could reflect differences in how individual farms managed risk in a period of rapidly fluctuating commodity prices,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

The decline in farmer sentiment spilled over into the Farm Capital Investment Index, which declined 10 points to a reading of 43, down 50% since the beginning of the year and the lowest investment index reading since April 2020. Fewer farmers this month said they planned to increase their machinery purchases than on the August survey as just 8% of respondents plan to increase purchases, down from 10% last month. In a follow-up question, over half (55%) of respondents reported that their farm machinery purchase plans have been impacted by low farm machinery inventories, likely contributing to weak sentiment regarding whether now is a good time to make large investments. Although plans for machinery purchases fell, producers’ plans for new construction rose this month with 13% expecting to increase construction of grain bins and farm buildings, up from 8% in August.

Producer concerns about rising input costs rose sharply this month with over one-third of respondents saying they expect input prices to rise by more than 12% in the coming year, which is six times the average farm input inflation rate of the last decade. Inflation expectations were higher this month across the board with the percentage of respondents expecting input inflation to rise above 12% doubling since July with an increase to 34%, up from 21% last month.

Despite September’s decline in farmer sentiment, farmers remain bullish about farmland values. The Short-Term and Long-Term Farmland Values Expectations Indices rose this month, with the long-term index hitting a record-high reading of 159, which is 4 points higher than the previous month. The short-term index rose nine points to 155, which is its third-highest reading since data collection began in 2015. Additionally, about one-half of corn/soybean growers continue to say they expect farmland cash rental rates to rise above 2021 levels in 2022. Among growers who expect cash rents to increase, 44% said they expect rental rates to rise from 5% to less than 10%, and three out of ten respondents indicated they expect rates to rise by 10% or more.

In early 2020, about 70% of producers expected agricultural exports to increase over the next five years. Since then, farmer expectations regarding future agricultural trade prospects have continued to weaken with only a few exceptions. September recorded the lowest percentage (37%) of growers expecting agricultural exports to increase since the question was first posed early last year. Concerns regarding the future of agricultural trade could be another factor behind weakness in the Future Expectations Index.

Read the full Ag Economy Barometer report. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results. For even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.