By Kami Goodwin | Purdue University

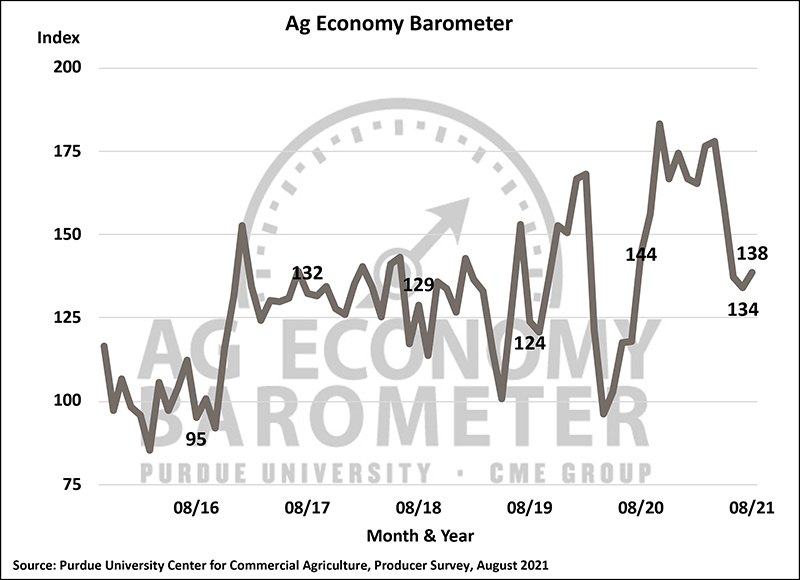

WEST LAFAYETTE — The Purdue University/CME Group Ag Economy Barometer improved in August, up four points to a reading of 138. The modest rise was attributable to improvements in both of the barometer’s sub-indices. The Index of Current Conditions rose nine points to a reading of 152, and the Index of Future Expectations rose two points to a reading of 132. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted Aug. 23-27.

In August, producers had a more positive view of their farms’ financial situation than earlier this summer. The Farm Financial Performance Index rose 11 points to 110, its highest reading since May, as more farmers indicated they expect profitability to be better this year compared with 2020.

“Although corn, soybean and wheat prices have declined in recent weeks, farmers have more confidence in their 2021 revenue expectations,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Yield prospects stabilized or improved for many producers in August as some precipitation fell in areas that had been abnormally dry and drought-stricken. That helps explain this month’s improvement in the Farm Financial Performance and Current Conditions indices.”

Producers are becoming increasingly concerned about farm input price inflation. On the August survey, 39% of respondents said they expect input prices to rise by 8% or more in the next 12 months, up from 30% who felt that way in both June and July. One in five producers (21%) expect farm input price inflation to exceed 12% in the next 12 months. Just 13% of producers surveyed said they expect input price pressure in the upcoming year to fall in a range of 0 to 2%, which would be similar to the average rise in farm input prices over the last decade.

Both the Short-Term and Long-Term Farmland Values Expectations Indices rose by four points in August compared with July, as producers remain optimistic that farmland values will continue to rise. At the same time, about one-half of corn/soybean growers expect farmland cash rental rates to rise above 2021 levels in 2022. Among growers who expect cash rents to increase, 44% said that they expect rental rates to rise from 5% to less than 10%, with one-third of respondents indicating they expect rates to rise by 10% or more.

The Farm Capital Investment Index leveled out after four consecutive months of declines, up three points to a reading of 53. The small improvement in the index could be traced to fewer producers in August saying they planned to reduce their farm construction activity compared with a year ago. Farmers’ machinery purchase plans reported on the August survey were unchanged from those reported in July.

“Industry reports continue to suggest that supply chain challenges are hampering farmers’ machinery purchase plans and could also be playing a role in reduced construction activity,” Mintert said.

The August barometer survey included a series of questions designed to learn more about producers’ use of cover crops in their farm operation. Nearly two-thirds (65%) of respondents indicated they currently use or have used cover crops in the past. Among producers currently using cover crops (41%), nearly half (47%) began planting cover crops within the last five years, while 29% have been planting cover crops for 10 years or more. Most producers report that they plant cover crops only on a portion of their farms’ acreage. Fifty-nine percent of cover crop users said they plant cover crops on 25% or less of their total acreage, while 10% of cover crop users reported planting cover crops on 75% or more of their acreage. When asked why they choose to plant cover crops, the most common responses (in order) were to improve soil health, improve erosion control, and improve water quality. Although the existence of carbon sequestration contracts requiring the use of cover crops is a relatively new phenomenon, 10% of cover crop users said that was one of the reasons they choose to plant cover crops.

Read the full report at https://purdue.ag/agbarometer. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.