By Kami Goodwin | Purdue University

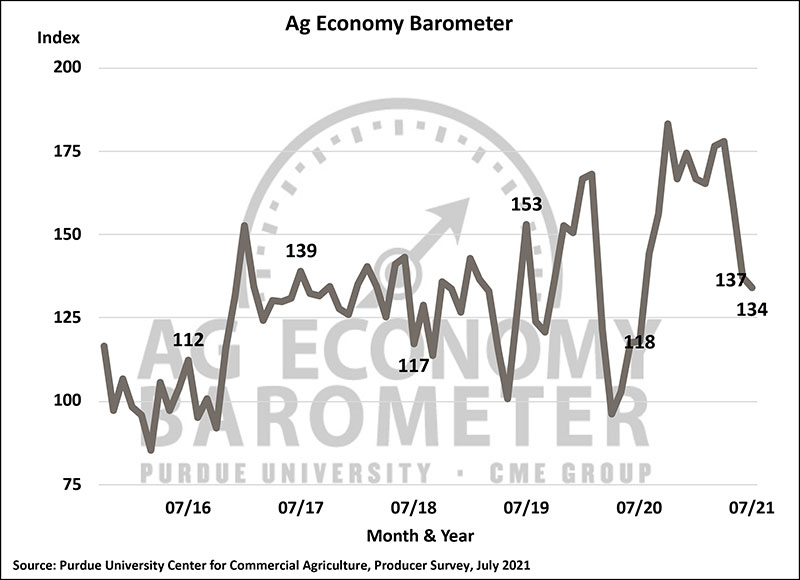

WEST LAFAYETTE — The Purdue University/CME Group Ag Economy Barometer leveled off after two months of sharp declines, down just three points to a reading of 134 in July. Both producers’ sentiment regarding current and future conditions also dropped. The Index of Current Conditions was down six points to a reading of 143, primarily as a result of weakened principal crop prices. The Index of Future Expectations was down two points to a reading of 130. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted July 19-23.

“This month’s sentiment index marks the lowest barometer reading since July of 2020 and actually marks a return to sentiment readings observed from much of 2017 through 2019, when annual average barometer readings ranged from 131 to 133,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “Producers’ sentiment regarding their farms’ financial condition was more optimistic when prices for corn, soybeans and wheat were surging last fall, winter and early spring. Still, recent sentiment readings suggest farmers remain cautiously optimistic about financial conditions on their farms.”

There was a modest improvement in the Farm Financial Performance Index, which asks producers about expectations for their farm’s financial performance this year compared to last year. The index improved three points from last month to a reading of 99 and remains 43% higher than in July 2020 when the index stood at 69.

The Farm Capital Investment Index declined for the fourth consecutive month, down four points to a reading of 50. Weakness in the investment index was primarily attributable to more producers indicating they plan to reduce their farm building and grain bin purchases in the upcoming year. Two-thirds of July’s respondents said their construction plans were lower than a year earlier, compared with 61% who indicated that in June. Plans for farm machinery purchases were also somewhat weaker, with a shift of more respondents planning to reduce their machinery purchases compared with last year instead of holding them constant.

Producers were also asked about their expectations for farm input prices. Just over half (51%) of the producers in the July survey expect input prices to rise 4% or more over the next year, 30% expect costs to rise 8% or more, and nearly one out of five (18%) expect input prices to rise by 12% or more.

“It is important to point out that these expectations are markedly higher than the rate of 1.8% per year that input prices rose over the last decade,” Mintert said.

Farmers remain optimistic about farmland values, although recent value increases could make some producers more cautious about where land values are headed in the next one to five years. The Short-Term Farmland Values Expectations Index weakened this month to a reading of 142, down six points from June, and the long-term index weakened to a reading of 151, down four points from a month earlier. While both indices remain near all-time highs, Mintert suggests recent declines in the farmland indices could be more of a reflection of the rapid increase in farmland values over the last year, leading producers to be cautious about the likelihood of further price increases. For example, Purdue University’s annual Farmland Values and Cash Rent Survey, conducted in June and published in late July, indicated that Indiana cropland values rose 12%-14%, depending on land quality, compared with the June 2020 survey results.

Finally, both the June and July barometer surveys included questions on leasing farmland for solar energy production. The percentage of all respondents who have engaged in solar energy leasing discussions ranged from 6% (July survey) to 9% (June survey). New to the July survey, producers were also asked if either they or one of their landlords had signed a solar leasing contract, with 4% indicating an agreement had been signed. In a follow-up question on both surveys, producers were asked about the lease rates being offered by solar leasing companies. In July, more respondents reported lease rates being offered that were greater than $1,000 per acre than on the June survey. However, Mintert noted that more information is needed, as the number of respondents reporting lease rates remains quite low and the rates are variable.

Read the full Ag Economy Barometer report online. This month’s report includes additional insight into producers’ thoughts on farmland cash rental rates and the Executive Order on Promoting Competition in the American Economy signed in early July by President Biden. The site also offers additional resources – such as past reports, charts and survey methodology – and a form to sign up for monthly barometer email updates and webinars.

Each month, the Purdue Center for Commercial Agriculture provides a short video analysis of the barometer results, available online. For even more information, check out the Purdue Commercial AgCast podcast. It includes a detailed breakdown of each month’s barometer, in addition to a discussion of recent agricultural news that affects farmers.